Quick Pitch

Ticker: FRAGUA

Share Price: $483 MXN

Market Cap: $2.6B USD

Enterprise Value: $2.3B USD

Net Cash: $320M USD

USD/MXN Rate: 17.60Farmacias Guadalajara is a Mexican pharmacy chain trading at ‘23 forward 4.2x EV/EBITDA and 7.5x EV/FCF

Methodical and controlled growth initiatives have resulted in a revenue CAGR of 16% over the past 5 years

Growth has been fueled almost entirely via reinvested cashflows. The company has a strong balance sheet with $320 million in net cash

FRAGUA shares are cheap for 2 reasons:

Shares are tightly held by insiders, have low liquidity, and are not part of the Mexican IPC index thereby drawing minimal institutional interest

Fierce sector competition in the retail pharmacy space. There are at least 6 major pharmacy groups plus national grocery chains with in-store pharmacies

For the patient investor, Farmacias Guadalajara is the best risk/return consumer staple in Mexico

Overview

Note: Farmacias Guadalajara earns the majority of its revenue in MXN. For simplicity, I have converted many historical figures to USD using yearly average FX rates.

Farmacias Guadalajara owns a chain of 2,632 drugstores across all 32 Mexican states. The company was founded in 1942 in Guadalajara, Jalisco as is commonly abbreviated as Fragua. Most of its stores follow a “Super Farmacia” format and carry a wide assortment of products including medicine, food and beverages, personal hygiene products, home products, photo printing, and even freshly baked goods. The stores are similar to what you would find at a CVS or Walgreens in the US. Fragua also sells private label products throughout its stores. The majority of the stores are leased.

Fragua operates out of 3 distribution centers located in Guadalajara (west), Monterrey (north-east) and in the state of Hidalgo (center). The company owns and operates 3 additional business units including a security company (Organización de Vigilancia Commercial), a transport & logistics company (Transportes y Envíos Guadalajara), and a photo printing lab company (Fotosistemas), all of which jointly service the primary pharmacy business.

The company’s revenue and store count growth since its IPO in 1997 has been incredibly consistent. Most impressive is that the growth has been achieved almost entirely through reinvested capital, without any follow-on equity, and while keeping a strong net cash position at all times. Fragua has a target of opening 120 stores per year, an objective it has met going back 10 years. New store opening and revenue CAGRs since 2010 are 9.7% and 13.6%, respectively.

Fragua reported $115m USD in growth capex in 2022 and opened 140 new stores. This assumes a new build cost of roughly $820k per store or lower, as some of the funds were used for outfitting the Hidalgo distribution center which became operational in 2021.

Farmacias Guadalajara pays a modest yearly dividend but has raised its payment every year for the past 24 years. The company paid $11.30 MXN/share back in March, representing a 2.3% yield at today’s price and a 33% payout ratio to net income. Fragua is within a year of meeting the definition of a dividend aristocrat (25 years of dividend raises), although technically falls a bit short of the $3b USD market cap threshold. On the other hand, buybacks have been immaterial with only 240k shares repurchased over the past 2 years (97m FDSO).

The current CEO is Javier Arroyo Chavez, son of founder Francisco Arroyo, who has been in control of the company since 2003. The Arroyo family currently owns 76% of outstanding shares.

Operating Results

Farmacias Guadalajara continues to post excellent results quarter after quarter and the market finally took notice this year with the stock up 45% YTD. Despite the increase the stock remains cheaply valued in my opinion.

Fragua opened 64 new stores in 1H2023, posted a 11% increase in customer traffic, and grew top line sales by 13%. Gross margins also increased YoY to 22.6% or +120bps, while net income margin increased to 3.7% or +50bps compared to last year. The overall gross and net margin improvement can be attributed to higher sales and succesful cost controls. Capital expenditure over the first half of the year was $81m USD.

I want to highlight a quote by management on last year’s full annual report which I think nicely summarizes the thoughtfulness and discipline around the growth strategy.

“Despite the company’s investments over the last couple of years we have maintained an adequate level of cash generation. The only debt funding raised has been short-term to cover working capital needs, and long-term to finance investments related to our distribution centers. However, the aggressive growth and dividend payout has been financed mainly by internal cashflow. The company has sufficient resources to continue its aggressive growth plans without compromising our balance sheet going forward.”

Competition

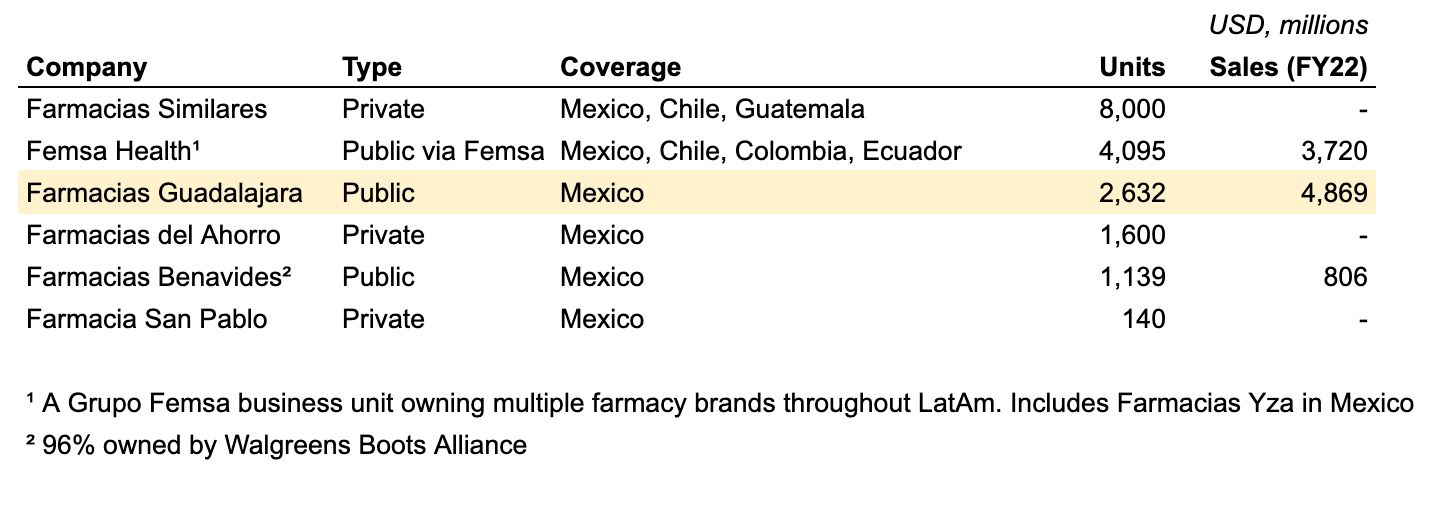

Direct pharmacy competitors in Mexico include Farmacias Similares, YZA, Del Ahorro, Benavides, and San Pablo. I estimate Fragua to have between 12-15% marketshare of retail pharmacy sales based on 2022 data.

Fragua does not mention them in their annual reports but the largest player in the space is Farmacias Similares which owns over 8,000 stores throughout Mexico using a low-cost franchising strategy

Farmacias Similares exclusively sells generic drugs and targets a lower income customer, but it still competes on the retail front selling everyday goods and products

Fragua and its direct peers will usually carry both branded and generic drug formats across their stores

Farmacias YZA is fully owned by Grupo Femsa ($FMX) under the Femsa Health division, which owns over 4,000 points of sale throughout Latam

YZA can be viewed as the flagship brand but Femsa owns other brands throughout LatAm including Moderna, Cruz Verde, and SanaSana

Despite the smaller footprint, Fragua reported $4.9b USD in 2022 net sales versus Femsa Health’s $3.7b

Farmacias del Ahorro (“The Savings Pharmacy”) is probably the closest direct competitor in terms of pricing, footprint, and exclusive focus on the Mexican market, but remains a privately held company

Benavides is 96% owned by Walgreens Boot Alliance and has a smaller footprint and yearly sales of $806m USD

Though publicly traded, Benavides is part of the “zombie company” cohort listed on the BMV with very limited trading activity

Other pharmaceutical competition includes the grocers with in-store pharmacies including Walmex, Chedraui, HEB, Soriana, and Lacomer

I looked at prices offered by Fragua and competitors on select products and its difficult to rank them based on low vs. high end pricing; outside of Farmacias Similares which does compete solely on discount pricing. Guadalajara and Del Ahorro seem to be the most competitive on price and had easy to navigate and efficient e-commerce catalogs. Benavides tended to have the worst prices and I found their website to be dysfunctional. Walmex offered similar pricing to Fragua and Del Ahorro on many products.

Based on this I would describe Guadalajara’s offering as being the most competitive together with Del Ahorro. Fragua has sufficient points of sale to cover consumers across the country, is competitive on price, and is also able to service middle and higher income customers through branded drugs. As opposed to the grocery chains, Fragua offers 24/7 access points and is generally more convenient for quick drop-ins to pick up medicine and emergency items.

Valuation

Fragua shares currently trade at a trailing 8x EV/FCF and 15x earnings which I think is cheap for an unleveled business that has grown at a 14% CAGR over the past 15 years

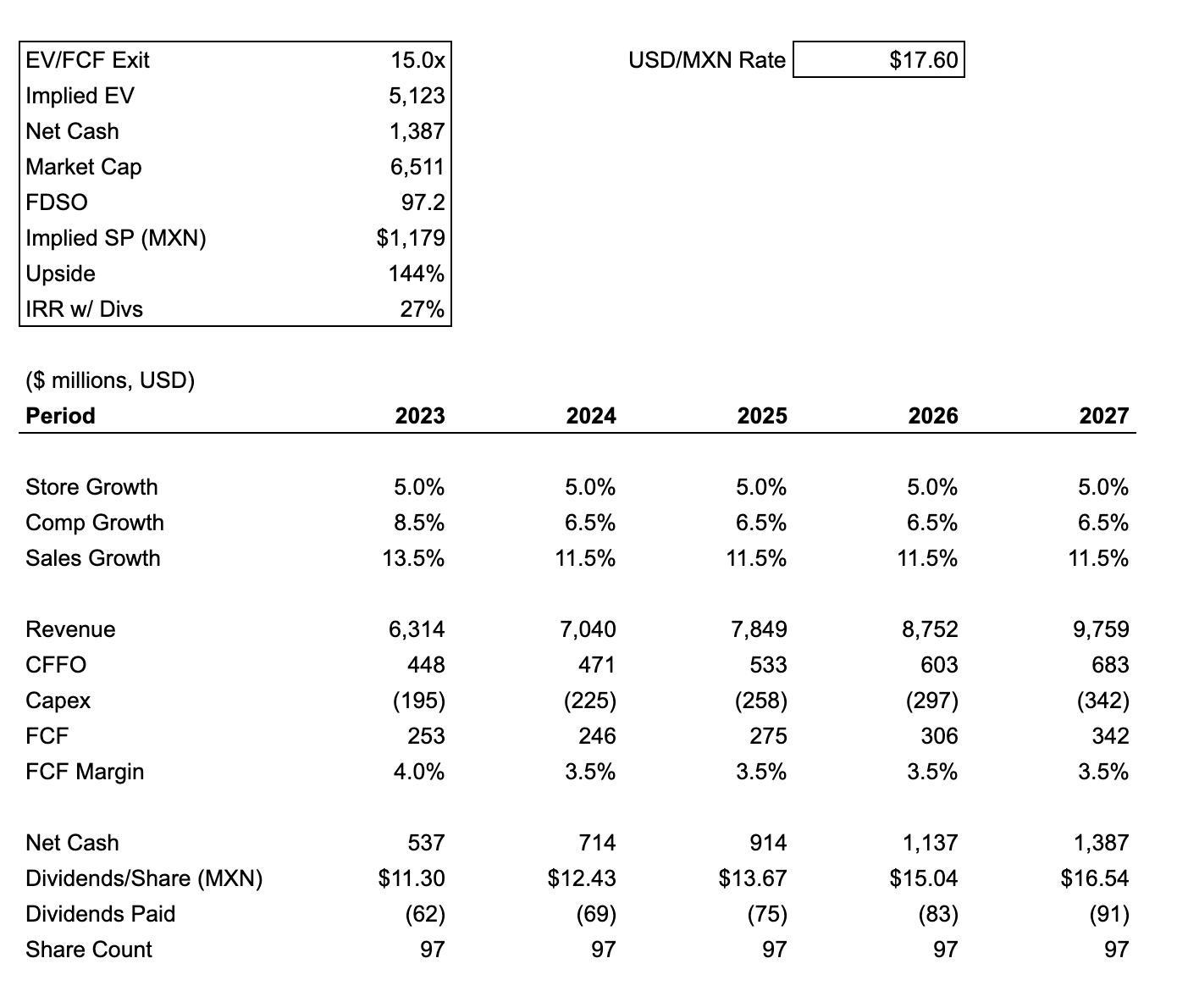

I assume that store count and SSS sales grow at 4% and 6.5% respectively, or 11.5% total growth for the next 5 years

This is 200 bps lower than historial growth rate of 13-14%

Applying a 15x EV/FCF multiple on 2027E figures translates to a $1,179 MXN share price, or ~150% upside from today

Implies a 27% IRR factoring dividend payouts

This multiple would bridge the valuation gap to consumer staple peers such as Grupo Femsa, Soriana, and Lacomer with FCF multiples in the low 20’s

I do not expect the company to lever up the balance sheet but there is sufficient room for management to pay much higher dividends from today’s 33% payout ratio

Risk to the thesis include FX risk, excessive competition and margin deterioration in the retail pharmacy space, and lower growth due to market saturation

Final Thoughts

At its current valuation I think Fragua is the most compelling buy in the Mexican consumer staple category

Fragua is present in 460 cities and all 32 Mexican states. Despite potential saturation the pharmacy retail market continues to grow at a healthy clip

Mexico’s health sector GDP has grown at a 6.7% CAGR from 2014-2022, higher than the overall GDP growth rate. It is LatAm’s 2nd largest pharmaceutical market behind Brazil

Rising median incomes may expand the TAM for branded drugs which is severely restricted by generic drug availability

I trust that management will show restraint in pursuing economically sound store growth and will pump the brakes once it reaches market saturation

Potential saturation would be partially remediated by higher FCF margins and capital returns to shareholders via dividends

It is well known that Walgreens has been trying to sell its Benavides stake for some time now

WBA sold Farmacias Ahumada (FASA), its pharmacy division in Chile, in May 2023 for an undisclosed amount

A sale of Farmacias Benavides in Mexico would provide a good data point but I do not see Fragua as a potential interested buyer

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

If you liked this article please consider subscribing and sharing. I do long-form write-ups on under-followed companies in North America.

I wonder about the discrepancy between Ev/FCF and PE: are lease payments accounted for correctly in FCF metric?

Also, h1 revenue(growth) in USD greatly benefits(overstated) by stronger mxn