Update #1

A few updates on Nathan's Famous ($NATH), Farmacias Guadalajara ($FRAGUA), and Medica Sur ($MEDICA)

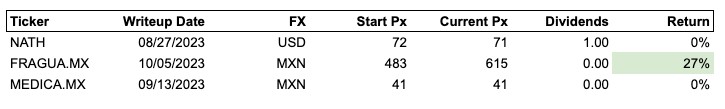

I wanted to provide a few quick updates on past writeups. Thankfully my portfolio has performed much better than what these 3 ideas would suggest. That said I remain bullish on both Farmacias Guadalajara and Medica Sur.

Nathan’s Famous ($NATH)

Nathan’s shares are basically flat from when I wrote up the idea in August 2023. I pitched the stock at $72 and its at $71 today (plus two $0.50 quarterly dividend payments).

Link to my original pitch here:

What initially attracted me to Nathan’s was the limited capital required to grow the business. There was no real catalyst here beyond a cheap valuation in the defensive CPG space. The most insightful pushback I received at the time was that management had limited levers to pull and largely depended on third parties (Smithfield Foods) to deliver on growth. I think this pushback was pretty accurate in retrospect.

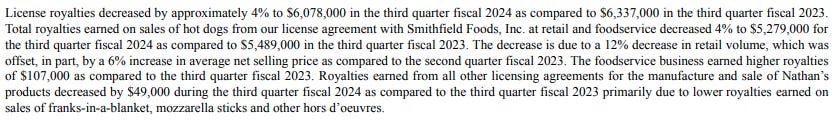

NATH announced third quarter results on February 1st (fiscal Q3 ending Dec 2023). Although topline sales grew 10% the report showed a lot of empty calorie revenue and corporate costs creeping up. The branded products segment which makes the bulk of sales (but not income) increased by 18% on 8% volume growth. Unfortunately this growth was offset by a 22% increase in COGS. The report cited a steep increase in beef trimming costs which have not been fully passed on to the consumer. License royalties, which have close to a 100% contribution margin, were down 4% in the quarter.

Corporate G&A increased by 33% but did include a $500k cash bonus to the executive chairman that should be a one-off. Nathan’s also redeemed $20 million of its senior notes due 2025. That brings net debt down to a manageable $43 million or 1.2x net leverage.

Branded products - selling hot dogs at parks and stadiums - is not a good business but I was surprised to see a drop in licensing royalties from Smithfield. The drop can be explained by a 12% decrease in retail volume vs. only a 6% selling price increase. I think it’s reasonable to assume a trading down dynamic as higher protein costs continue to squeeze the consumer. From the latest 10Q:

The company trades at a trailing 15x PE multiple but margin compression has hit the bottom line. Outside of beef input prices coming back down I do not see what is going to drive a meaningful rerating of the stock price. Management seems content to operate the business in a conservative fashion without adding much restaurant operations growth (via franchising) or expanding its line of licensed products with Smithfield Foods. That said, I think the stock remains fairly priced today with good downside protection.

Disclaimer: I remain long $NATH shares but this is a position I would trim or sell to pursue higher return opportunities.

Farmacias Guadalajara ($FRAGUA)

At $615 pesos per share FRAGUA is up 27% since my publication. The stock briefly traded to around $660 last week after earnings but has given back some of the gains. This is a top 7 holding for me and I would look to add on any material pullbacks.

Link to my original write up below:

Earnings were released on February 27th and results were solid. Full year sales grew 12% (SSS +7.5%) and gross margins expanded by 2.3%. The company reported net income of $4,500 million MXN or $44 pesos per share. A small caveat here is that the BMV report used total share count and ignored about 5.5m treasury shares held on balance sheet. Using an outstanding share count of ~97.1m we get an EPS of $46 pesos. I am still waiting for the company’s official full-year report to confirm this.

I feel confident about owning this stock at a 13x PE while growing 12% with decent margin expansion. The company added another 150 stores in 2023 and continues to invest in its 3 distribution and fulfilment centers.

Free cash flow conversion was a lot weaker in 2023 impacted by 30% higher capex spend and a $3,000 million MXN inventory build. Most of the additional capex went towards improvements to the western distribution center in Guadalajara. As a result the company only generated ~$18 pesos per share in FCF. But I expect stronger numbers as the company laps higher capex spend and future store expansion costs represent a lower investment relative to its total installed store base.

Fragua will announce a yearly dividend during its mid-March shareholder meeting. I think a 10-15% increase over last year’s $11.30 MXN / share seems feasible. This would be a very conservative payout ratio. Unfortunately share buybacks have been nonexistent the last couple of years.

As with a lot of the Mexican stocks the company does not provide a lot of details in its reports. Add the fact that FRAGUA shares are not part of the IPC index and you also have limited analyst coverage. This provides a unique opportunity for retail investors to buy an underfollowed name that continues to execute. The market has clearly started to notice.

Disclaimer: I remain long $FRAGUA shares.

Medica Sur ($MEDICA)

Medica Sur, a single-hospital operator in Mexico, remains criminally underfollowed and undervalued. The stock has been glued to the $40-43 peso range and trades at $41 pesos today; unchanged from my initial writeup. Fundamentally the thesis from my pitch is playing out nicely. Core hospital operations remain strong, and management continues to monetize real estate holdings to buy back shares.

You can read my original pitch below:

Medica published its fourth quarter and full-year results on February 22nd. The company reported 7% top line growth and $906 million MXN in EBITDA (+22% YoY). This means shares are trading at less than 5x trailing EV/EBITDA. The company sold 4 real estate properties last September for $12.5 million USD (sale price set in dollars). Adjusting EBITDA for this non-recurring inflow still puts the multiple at only 6x.

The carrying value for the real estate was barely adjusted after the sale. The company reports land and building values of $190 million pesos ($11m USD) that I believe materially understates true value. Located within 1km of Estadio Azteca I think the hospital’s property values are set to benefit from the upcoming World Cup in 2026. Estimates put total capex needed for Azteca to be roughly $150 million USD with much more pledged by the government for infrastructure and transportation improvements.

Medica bought back 10.8 million shares or 10% of its outstanding shares during 2023 paying a total of $429 million pesos. That brings FDSO to 95.7m. I am interested to know how management is executing these buybacks as daily volume is only ~3k shares per day. Assuming 250 trading days, that is only 750k in yearly volume versus 10 million in buybacks. The most likely explanation is large block sales via brokered transactions with majority holders. At some point I hope this will lead to more open market repurchases that put positive price pressure on the stock. That said, I am impressed that management bought back 10.8 million shares at an average cost of less than ~$40 pesos.

Given that core hospital operations continue to hum along nicely and with buybacks acting as a strong price floor I remain optimistic on Medica’s performance from here.

Disclaimer: I remain long $MEDICA shares.